For those looking to earn money in an easily accessible way, apps provide plenty of avenues to consider. You can use your smartphone to take surveys, pick up a side gig, sell your unwanted stuff and more.

Here’s the scoop on nine free money-making apps. NerdWallet considered apps with at least 3.8 stars and 25,000 reviews in Google Play, the iOS App Store or both.

9 of the best apps to make money

The best money-making apps

1. Ibotta

Ibotta lets you earn cash back on in-store and online purchases at over 2,000 supported retailers. Originally for groceries, it has expanded to include clothing, entertainment and eating out, pet supplies and other categories. Offers can be product or retailer-specific. For others, you’ll need to complete an additional task such as watching a video or taking a poll.

There are three possible ways to earn cash back in stores: Add offers and submit your receipt in the app after your shopping trip (you have 7 days to send in your receipt through the app), link your retailer loyalty accounts or purchase a retailer gift card through the Ibotta app. For online purchases, you shop through the app or with the Ibotta browser extension on your computer.

Payment: PayPal, digital gift card or direct to a bank account.

Pros: You’ll receive cash back on in-store purchases quickly — typically within 24 hours. Ibotta also offers a welcome bonus to new users, referral bonuses and a variety of payment methods.

Cons: Making money can be a slow process. You must have at least $20 in cash back to redeem your earnings (some gift cards require at least $25 in earnings). For online shopping, the pending period for earning cash back varies by retailer. Ibotta also charges an account maintenance fee for inactive (no activity for 180 days) or deactivated accounts. The fee is deducted from your balance, not your bank account.

2. Rakuten

How it works: Rakuten (formerly known as Ebates) rewards shoppers with cash back on purchases from well-known retailers, restaurants and food delivery services. Users can also earn cash back on travel, gift cards and more. It’s straightforward: Create an account, tap on the store where you want to shop in the app, then make the transaction through the portal. You can also link a credit or debit card to your Rakuten account to earn cash back in-store — as long as you activate the deal through the app first. Rakuten credits the cash back to your account after it confirms the purchase with the retailer.

Payment: PayPal or “Big Fat Check.”

Pros: Thousands of stores and purchases are eligible for cash back, so you’ll likely find deals where you already shop. New users can earn a welcome bonus after their first qualified purchase. You can also earn welcome and referral bonuses. You can make an impact with your cash back earnings by donating a portion to nonprofit partners.

Cons: As with most cash-back services, you have to spend money to make money. You won’t see your earnings right away, either; Rakuten sends out payments every three months on the company’s payment schedule, and you need to hit the minimum cash-back balance to get paid. Unlike other apps like Ibotta, you have to remember to initiate your purchase in the app first. If you forget and make your purchase outside of the app, you can’t get credit retroactively.

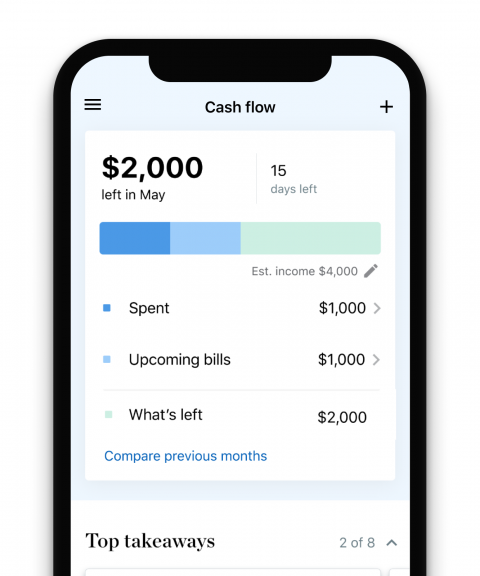

Money management made easy

NerdWallet tracks your income, bills, and shows you ways to save more.

3. Swagbucks

How it works: Swagbucks is a cash-back and rewards app. You earn points, called “SB,” by shopping online (there are over 1,500 participating retailers), taking surveys, watching videos, playing games or fulfilling other tasks through Swagbucks. You can redeem those points for gift cards, prepaid Visa cards or get cash back to your PayPal account. The total points awarded can vary by task. For example, surveys are typically worth about 40 to 200 SB points each. The minimum balance required to redeem depends on the payout option you choose, but some gift cards are available for as low as 300 SB.

Payment: E-gift card, prepaid Visa card or PayPal. You can also redeem SB for Bitcoin through the new Cryptovoucher Gift Card options.

Pros: Swagbucks offers many easy ways to earn rewards, and there’s no waiting period to cash in. Payments usually arrive within 10 business days after redemption. You can also get a $10 bonus with a qualifying $25 purchase when you join.

Cons: It doesn’t pay much; one SB is worth about a cent. With many tasks valued at pennies, it can take a fair amount of time and effort to make substantial money. Additionally, you won’t qualify for every survey or task, although users can earn up to 5 SB per day if they disqualify. Users often report getting kicked out of surveys in the middle of taking them. This can be due to demographics or dishonest or inconsistent answers, according to Swagbucks.

4. Fiverr

How it works: Fiverr is a freelancing marketplace that features gigs in over 200 categories, such as musician and video and animation. Create an account first, then you can set your profile as a “seller” highlighting your expertise. Post the gig you’re offering, which will include pricing and a description of your services. Pricing ranges from $5 to $995. Clients, known as “buyers,” can click through and place orders. You’ll get paid once you complete the job. Fiverr assigns seller levels based on performance. As you move up each tier, you’ll be able to sell more “extras,” such as paid consultations.

Payment: PayPal, direct to a bank account, Payoneer or credit to a Fiverr Revenue Card (a prepaid card). Minimum withdrawal amounts vary, and your payment processor may charge a withdrawal fee, depending on which option you choose.

Pros: You don’t have to worry about tracking down buyers because they come to you. You can also earn tips. Fiverr also boasts its flexibility, allowing sellers to complete gigs in their own time or around their 9-5 jobs.

Cons: Fiverr takes 20% of your earnings for every gig, including tips, and there’s a standard 14-day waiting period to withdraw money after completing an order (top-tier sellers wait seven days for funds to clear).

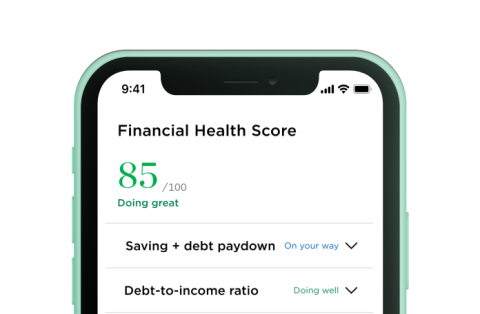

A smart view of your financial health

Get a quick read on how you’re set up to meet expenses and money goals.

5. Upwork

Upwork connects freelancers to gigs in writing, design, marketing and other categories on the marketplace. First, you’ll create a profile. It should include information such as the field you’re interested in plus your qualifications, availability and desired rate. Then, you can submit proposals. Clients will review them and offer projects if you seem like a good fit.

You begin each month with a set number of “Connects,” which are like credits that allow you to contact prospective clients. You can earn or pay a small sum for more Connects, but you won’t be charged when clients contact you. You can get paid on an hourly or per-project basis.

Payment: Direct to U.S. Bank, direct to your bank account, wire transfer, Instant Pay, PayPal and Payoneer. Charges apply to some payment options, so be sure to check Upwork for details.

Pros: Upwork helps take the work out of seeking out clients, establishing relationships and getting paid. The service also gives you the flexibility to set your preferred rate and schedule.

Cons: The app is free to download, but initiating contact with lots of clients costs money. Users also get charged a service fee. Upwork takes a 10% cut of your earnings based on how much you’ve billed a client. The more you earn, the more you get to keep. However, you won’t get paid until 10 days after the billing period ends. Remember, too, that you’re competing with other freelancers on the platform. That means clients may choose those who’ve set lower rates.

6. OfferUp

How it works: OfferUp, which combined with competitor Letgo in 2020, functions as a local marketplace you can use to sell your stuff. If you want to reach a broader audience, OfferUp also allows shipping anywhere within the United States except for Alaska, Arkansas and Hawaii. Create an account and snap a picture of your smartphone, car, sofa or whatever it is you’re selling. Once you add a title, description and price, you can post your listing and chat with buyers directly through the app. Then, you’ll ship to or arrange a meeting with the buyer.

Payment: When selling locally, OfferUp recommends sellers take cash from buyers and stay clear of accepting payments by check, cashier’s check or using other apps. For shipments, sellers can set up deposits to a debit card or bank account.

Pros: Creating a listing is simple and fast, and you’ll get paid instantly when you make a cash sale. You can also view a prospective buyer’s reviews and ratings to get an idea of how trustworthy they are beforehand. If you ship your item, the buyer pays the cost, and OfferUp provides the label.

Cons: You’re responsible for meeting local buyers in person and handling transactions. Sellers must pay a 12.9% service fee, or a minimum of $1.99, for shipments. To be successful, you’ll likely need to invest in a printer so you can print the shipping labels and mail items to buyers.

7. Poshmark

How it works: The Poshmark app is tailor-made for selling clothes, accessories and even home decor. After signing up, you take or upload photos of your item, fill out a description, price it and share the listing. You can also feature items in the app’s “Posh Parties,” which are virtual shopping events centered around particular brands, categories and themes. Poshmark emails you a prepaid and pre-addressed shipping label once a purchase is made. Then, you send the package via USPS.

Payment: Check, PayPal, Venmo, Instant Transfer or direct deposit to a bank account.

Pros: Poshmark facilitates the entire process, from selling to shipping. Plus, you don’t have to meet with strangers to make a sale. The company will cover lost packages and handle issues between you and the buyer. Getting paid is relatively quick, too; Poshmark issues the money within three days of the buyer receiving the order.

Cons: You’ll pay a fee for selling through Poshmark. The company takes a $2.95 commission for sales under $15 and a 20% commission for sales of $15 or above.

8. Premise

How it works: Premise is a task-based app that provides rewards for users who complete simple tasks. You get paid for sharing local insights to help businesses and communities. Some options include sharing information and photos on what’s happening in your area like traffic jams and local events or taking surveys. You create an account by signing up with an email address. Once enrolled, you can browse the app for activities to complete for cash. You can also set notifications to receive the latest tasks available.

Payment: PayPal, Bitcoin or Payoneer.

Pros: The app markets itself as a community-first service where your opinion can help shape your community. Tasks may be associated with public service entities like libraries, hospitals, stores and governance-related activities.

Cons: Depending on where you live, there may be limited tasks available. Some users state the app itself is also challenging to use, making it difficult to locate the items or tasks in a community.

9. Upside

How it works: Upside provides cash back for gas, grocery and restaurant purchases. On average, Upside says users earn 8% cash back on groceries and dining, and there are more than 50,000 retailers and restaurants that participate. Once you sign up, you claim offers through the app and pay for your purchase as you normally would with a credit or debit card. You’ll either check in on the app or scan your receipt to earn your reward. You can cash out anytime.

Payment: PayPal, gift cards or deposit to your bank account.

Pros: Upside focuses on daily essential purchases that many consumers may already be making. According to the app, frequent users earn more than $300 annually by adding Upside to their normal routine.

Cons: The app doesn’t always work as it should, according to several user reviews. To be successful, you’ll have to have the patience to work through technical issues and the receipt uploading process, which some users say isn’t worth the time investment for a minor payout.